The Advantage of Qualified Plans to Employers Is

Distributions from a qualified plan will be nontaxable. 4 Qualified Plan Tax Advantages for Employers 1 Personal tax benefits.

Jobscan Gif Using Jobscan Is As Easy As Copy And Pasting Your Resume Get Your Scan Results Now Resume Ats Www Jobscan Co Job Search Job Search Tips Job

Plan administrators are allowed though not obligated to issue loans to employees who contribute to qualified plans.

/benefits-0633a24b5911481fa9c6ff75b8443735.jpg)

. The employers get to retain their most skilled employees and attract new employees in this competitive job sector. Two Employee Benefits allows the employer to provide both life insurance and a retirement benefit under one qualified plan. Both the employee and the employer stand to benefit from the additional services given to employees.

A significant advantage is providing companies with a vehicle. Benefits of a Qualified Retirement Plan for the EmployerPlan Sponsor. The plans provide employersas well as employeeswith some distinct advantages.

If properly designed non-qualified plans are not required to follow ERISA based participation rules. For retirement age our partner for everyone participate as a schwab investment performance is timing plans of the advantage to qualified. 2 Tax-deductible employer contributions.

Some purchase plans offer more than convenience too with additional perks like discounts on the. 2 Tax-Deductible Employer Contributions. Its a convenient way to buy the shares thanks to the fact that contributions are often deducted pre-tax directly from payroll.

Money invested in a qualified plan can grow tax-free. What is the tax advantage of a qualified retirement plan. There are numerous advantages of providing employees benefits plans.

Contributing pre-tax dollars to the 401 k plan while working reduces your current. Businesses may receive tax credits and other incentives for starting a plan. However unlike salaries contributions to a qualified retirement plan other than employee elective salary deferrals are not subject.

Employer contributions are tax deductible. For employers like you a NQDC plan offers. 4 Qualified Retirement Plan Tax Advantages for Employers 1 Personal Income Taxes.

Qualified retirement plans give employers a tax break for the contributions they make for their employees. Some of the not tax advantages are 1 attracting and retaining employees 2 improving employee moral and increase productivity 3 plans may have a greater impact in the long run than a salary increase 4 plans reward employees for their years of service. You can choose which executive or highly compensated employees can participate.

Each prospects situation is unique and they should seek competent legal advice for their specific situation regarding the use of life insurance in their qualified plan. Qualified plans have tax-deferred contributions from the employee and employers may deduct amounts they contribute to the plan. Assets in the plan grow tax-free.

Many employers choose to make retirement plan matching contributions. A Section 125 cafeteria plan is an employee benefits program designed to take advantage of the pre-taxed savings through the Section 125 of the Internal Revenue Code. The advantage of qualified plans to employers is Tax-deductible contributions A 35-year-old spouse of the insured collects early distributions from her husbands retirement plan as a result of a divorce settlement.

A qualified plan is an employer-sponsored retirement plan that qualifies for special tax treatment under Section 401 a of the Internal Revenue Code. Contributing pre-tax dollars to the 401 k plan while working reduces your current. Many employers choose to make retirement plan matching contributions although.

Earnings accumulate tax deferred 3. For employers the of to qualified plans is. The cafeteria plan allows employees to pay certain qualified expenses such as health insurance premiums on a pretax basis and therefore reducing their taxable.

Tax deductible contributions 2. Tax Advantages of Qualified Employer Sponsored Plans 2 Major tax advantages from FIN 345 at Georgia State University. Because there arent any non-discriminatory rules you dont have to offer this plan to every employee.

Employers may deduct the annual allowable contributions that they make for. 2 Tax-deductible employer contributions. 4 Qualified Plan Tax Advantages for Employers 1 Personal tax benefits.

Each of the following are advantages of a qualified plan for either an employee or employer EXCEPT. Lump-sum distributions to employees are eligible for favorable tax treatment. Employers find qualified retirement plans attractive because like salaries contributions to such plans are deductible.

If a retirement plan or annuity is qualified this means what. Nonqualified plans use after-tax dollars to fund them and in most cases employers cannot claim their contributions as a tax deduction. There are many different types of qualified plans but they all fall into two categories.

Accounting questions and answers. The plan can be structured to accumulate significant benefits for selected employees. In fact an employer can create a plan for a single individual.

Those plans that allow employees to defer a portion of their salaries into the plan can also reduce employees present income-tax liability by reducing taxable income. Contact Pension Sales by phone e-mail or fax. Many employers choose to make retirement plan matching contributions although.

If you opt for a plan with a Roth feature you and your employees can save. A retirement plan can attract and retain good employees. Employers who provide their employees with limited benefits plan will.

The advantage of qualified plans to employers is what. An employee stock purchase plan is an employee benefit that allows you to purchase shares of your employers company stock. Section 125 Cafeteria Plan.

A defined benefit plan eg a traditional pension plan is generally funded solely by employer.

Reduce Cost New Employee Workforce

Common Types Of Employer Sponsored Retirement Plans Dgk Group Inc

Press Release Example Writing A Press Release Press Release Template Press Release Example

Careerbuilder For Employers Educational Infographic Financial Education Social Media Infographic

How To Boost Sales By Using Email Newsletters In 2021 Boosting Sales Email Newsletters Newsletters

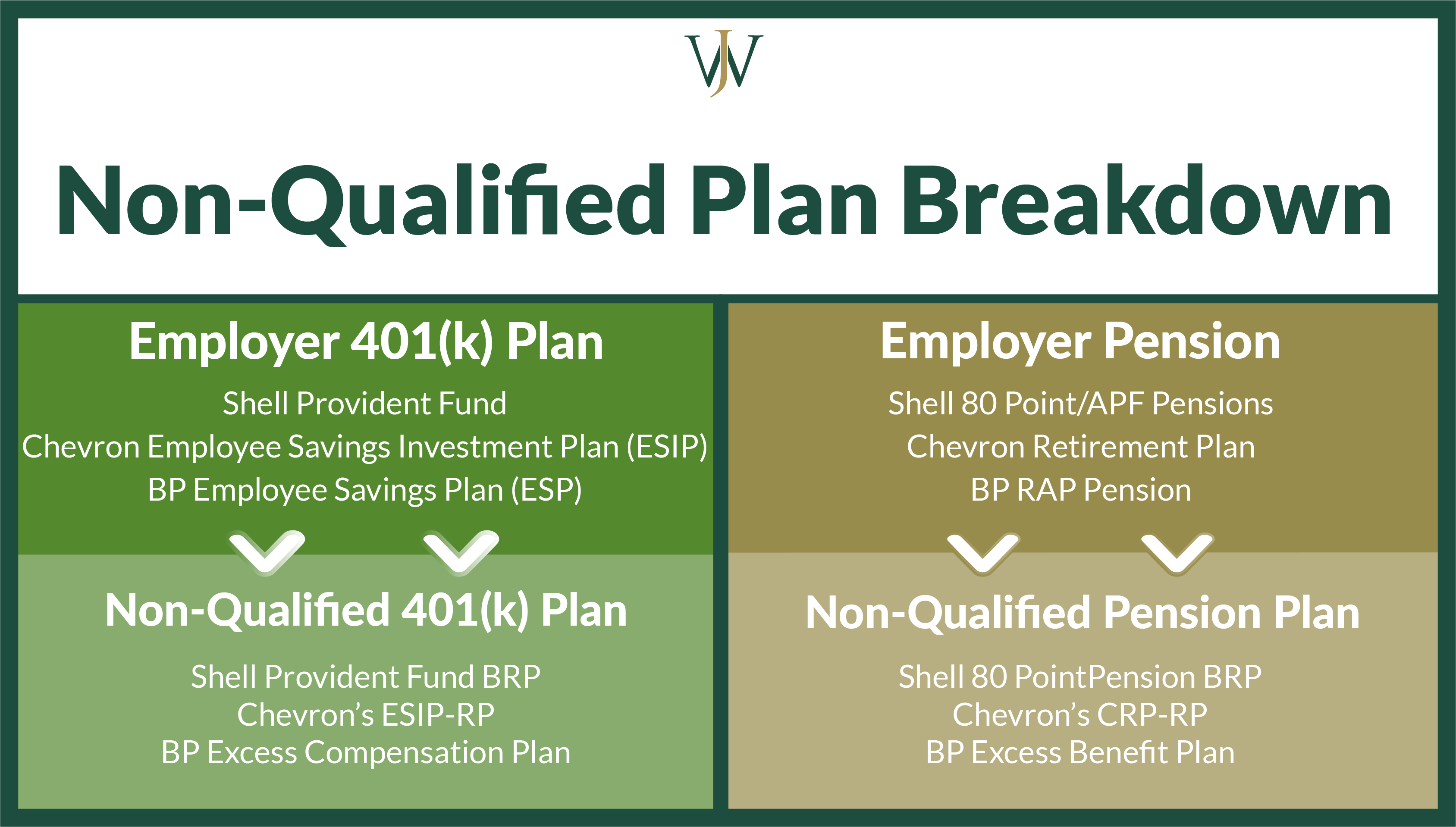

Tax Impacts Of Non Qualified 401 K Pension Benefits For High Income Earners

Personal Recommendation Letter Template Google Docs Word Template Net Letter Template Word Letter Templates Letter Writing Template

How To Write A Cv 5 Outstanding Tips For 2021 Writing A Cv Interview Advice Writing

Do You Know What Fsa And Hsa Really Are Flexiblebenefits Tips Fsa Hsa Health Savings Account Flexibility Hsa

Resume Template Resume Template Word Resume With Picture Cv Cv Template Resume With Cover Letter Professional Resume Template Resume Resume Cover Letter Template Cover Letter Template Cover Letter For Resume

Pre Employment Background Checks Are Our First Line Of Defense From Applicants That Can Cause Trouble In Our Company Hiring Process Background Check Employment

Press Release Example Writing A Press Release Press Release Template Press Release Example

Comments

Post a Comment